Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase coverage from the extended warranty providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of extended warranty providers. See our Privacy Policy to learn more.

Crash Course:

- Protect My Car reviews are generally positive and indicate a good customer experience.

- In our 2024 auto warranty study, Protect My Car earned an overall score of 4.4 out of 5.0.

- Protect My Car offers three levels of coverage, with an average cost ranging from $100 to $130 per month.

Protect My Car (PMC) is a veteran of the extended car warranty industry. The company has offered vehicle protection plans since 2005, earning its place among the top extended car warranty companies in the nearly two decades since.

In this Protect My Car review, we take a close look at the extended service contract provider’s coverage, average costs, claims process, and customer service. We also provide a few of PMC’s competitors to give you a short list of reputable providers to get quotes from and compare.

Protect My Car Review

In our industrywide review of the top extended warranty providers, Protect My Car earned 4.4 out of 5.0 stars, placing it sixth overall for 2024.

What stands out about the company is its high customer satisfaction levels. Consistently positive PMC reviews earned the company this year’s award for Best Customer Experience.

Protect My Car Pros and Cons

There’s a lot to like about Protect My Car if you’re considering extended coverage for your vehicle. However, the company does have some drawbacks.

| Protect My Car Pros | Protect My Car Cons |

|---|---|

| Easy access to claims over the phone | Not available in California or Washington state |

| Flexible financing terms of up to 48 months | Warranty coverage not available for vehicles more than 13 years old |

| Positive customer service experience |

What We Like About Protect My Car

Protect My Car earned one of the top scores in our 2024 extended warranty study as a result of performing well in every category. However, there are a few things that stood out to our team in particular:

- Flexible financing: Protect My Car offers payment terms of up to 48 months. This can bring down monthly payments and make coverage more affordable.

- Included benefits: All PMC plans include roadside assistance, trip interruption coverage, and rental car reimbursement.

- PMC Rewards: Protect My Car customers have access to PMC Rewards, a shopping and dining discount program.

Is Protect My Car Worth It?

An extended warranty from Protect My Car is likely worth it for car owners who want to avoid the risk of surprise repair bills. The provider is an especially solid option for people who value the customer service experience.

Protect My Car is also a good choice for vehicle owners who appreciate included perks. Benefits such as roadside assistance and PMC Rewards provide a little extra value with the coverage.

Protect My Car Highlights

Founded: 2005

Headquarters: Saint Petersburg, Florida

Coverage levels: 3

Protect My Car has been offering vehicle service contracts for nearly two decades. As a result, it’s earned a strong reputation among industry professionals and customers alike.

Extended warranties from Protect My Car are available in every state except for California and Washington.

Protect My Car Customer Reviews

Despite a strong track record of customer service, Protect My Car reviews are mediocre on some websites. The company currently has a C rating on the Better Business Bureau (BBB) and lacks accreditation from the organization.

Customers on the BBB website give PMC 3.2 out of 5.0 stars, which is still higher than many of its competitors. The company has a better score at Trustpilot, where customers give it a decent 4.2 out of 5.0 stars. Protect My Car receives an average score of 3.6 out of 5.0 stars on Google.

Expand the following section to read real Protect My Car reviews from customers.

Protect My Car Extended Warranty Costs

Our research team found that Ultimate coverage from Protect My Car costs between $100 and $130 a month for four years of coverage. There’s sometimes an additional down payment for activating coverage that ranges from $50 to $100.

In our 2022 extended warranty survey of 1,000 customers, we found that most drivers pay between $1,600 and $3,200 for the full length of their coverage. We found that Protect My Car quotes were typically higher than the industry average, though this isn’t always true.

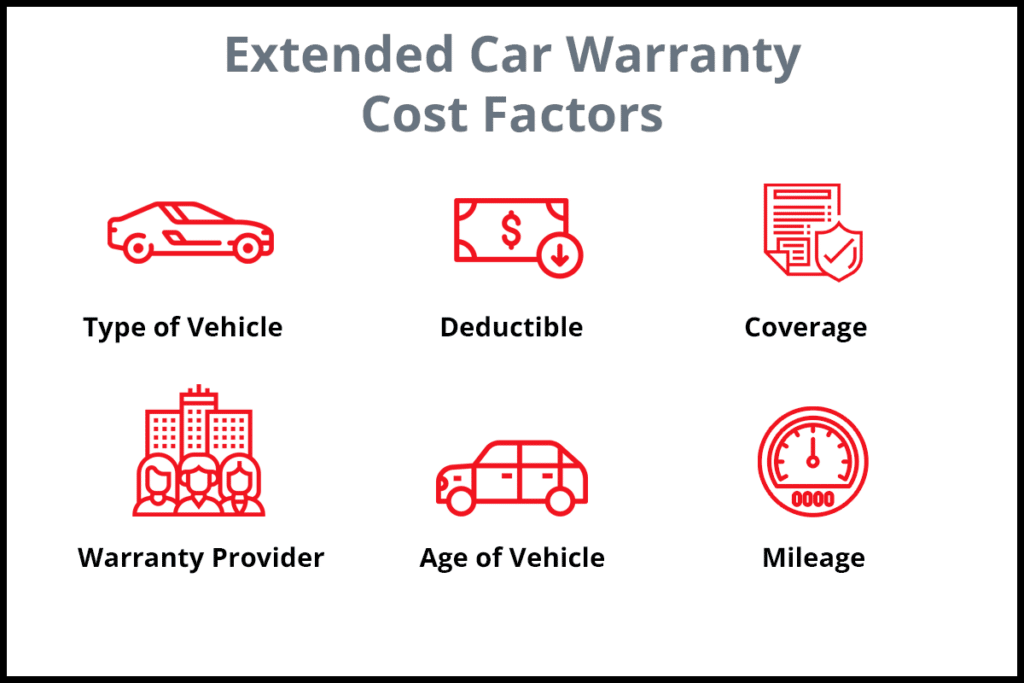

Extended Auto Warranty Cost Factors

The cost of an extended warranty for your car depends on several variables. These include:

- Type of car: The more expensive and larger your car is, the more you’ll pay for warranty coverage.

- Warranty deductible: A lower deductible means you’ll pay less out of pocket for covered repairs, but it also tends to increase the cost of your plan.

- Coverage plan: The more comprehensive your coverage plan, the more expensive it will cost.

- Warranty company: Companies offer different rates even on similar plans for the same vehicle. This is one of the reasons why it’s important to shop around for coverage.

- Model year: Older cars are more likely to have mechanical issues and therefore tend to be more expensive to cover.

- Current mileage: Cars with more miles on the odometer are likelier to need repairs. Because of this, providers tend to charge more to cover them.

Protect My Car Deductibles

Depending on which Protect My Car extended warranty plan you choose, you’ll pay the repair shop either 0$, $100, or $200 out of pocket when you take your car in for a covered repair. PMC will then cover the rest of your car repair costs.

Flexible Payment Plans

Protect My Car is one of the more flexible providers when it comes to how you pay for coverage. When you buy a plan from PMC, you’ll have the option to choose payment terms of between 36 and 48 months. You can also choose to pay for coverage upfront.

Protect My Car Coverage

Protect My Car offers three coverage plans to choose from. Options range from exclusionary coverage similar to a manufacturer’s warranty to powertrain coverage for older cars and high-mileage vehicles.

Protect My Car Warranty Coverage Details

Expand the section below to see the a table that details what’s covered and what’s not for each Protect My Car extended warranty plan.

Protect My Car Warranty Benefits

The company’s benefits are a frequent topic of positive Protect My Car reviews. The company packages more benefits into its plans than most others. These perks include:

- 24/7 roadside assistance

- Towing to a licensed repair facility

- Free oil changes

- Tire rotations

- Rental car reimbursement

Protect My Car offers above-average benefits and a 30-day money-back guarantee for drivers who wish to cancel their warranty plans.

How To Use a Protect My Car Warranty

Protect My Car has a simple and straightforward claims process. There are just a few steps you need to take:

- Check your contract: First, make sure your car warranty covers the repair you need. Your plan’s covered components and exclusions will be listed in the contract.

- Authorize repairs: Make a phone call to the PMC claims department and provide details about your need. A representative may request an inspection or diagnosis from the mechanic. If your repair is covered, the company will authorize the fix.

- Get to the repair shop: Take your car to any repair shop certified by the National Institute for Automotive Service Excellence (ASE®). Tell your mechanic about the protection plan.

- Pay for service: Protect My Car will pay the repair shop directly. However, you’ll need to cover the deductible listed in your contract upfront.

- Provide documents: To finish your claim, you’ll need to send over documentation to the Protect My Car claims department within 30 days.

Protect My Car Warranty Claims

Protect My Car reviews suggest that when you file a claim, it can be difficult to get coverage approved by the company’s claims department. This is somewhat concerning since the whole idea behind an extended warranty is to protect your vehicle in times of trouble.

Mechanics have also filed complaints saying they face issues getting in touch with PMC. Roadside assistance services should be easier to get if your car needs help but won’t need to head to the repair shop.

What’s Excluded From Protect My Car Warranties?

An extended auto warranty offers protection for repairs that come as a result of normal use of your vehicle. Even the most comprehensive plans won’t cover you in every situation, however.

Protect My Car Extended Warranty Exclusions

Here are some items that aren’t covered by a Protect My Car extended warranty:

- Preexisting repair needs

- Repairs caused by competitive driving

- Normal wear and tear items

- Repairs resulting from improper use or misuse

- Repairs resulting from lack of maintenance

- Weather-related repairs

- Damage due to car accidents, theft, or vandalism

Since your auto insurance policy may cover damage to any part of your vehicle in a collision, your warranty won’t cover that. Some parts aren’t covered under any condition, such as bulbs, hoses, catalytic converters, and other emissions components.

Protect My Car Cancellation Policy

If you want to cancel Protect My Car coverage, you can do so at any time. Depending on how long it’s been since you started coverage, you may even be eligible for a full refund.

How To Cancel a Protect My Car Warranty

To cancel your Protect My Car extended warranty, you need to take the following steps:

- Complete the online cancellation form at ProtectMyCar.com.

- Call the PMC phone number at 1-800-253-2850 to initiate the cancellation process.

- Send a paper copy of your completed cancellation form to:

Protect My Car LLC

570 Carillon Parkway Suite 300

St. Petersburg, FL 33716

It may also be a good idea to send your form through registered mail so that you can get delivery confirmation.

Protect My Car Review: Conclusion

Protect My Car offers comprehensive extended warranty coverage at higher-than-average prices. Your plan will include oil changes and tire rotations, which are rarely a part of vehicle service contracts. These perks may be what increases the overall cost of PMC coverage.

Protect My Car reviews largely favor it and point toward the company’s positive business practices and excellent customer service reputation. It’s one of the best auto warranty companies in the industry, and is an option worth considering and comparing for just about any person.

Protect My Car: Recommended Alternatives

While Protect My Car offers several coverage options and lots of extra perks, we suggest getting free, no-obligation quotes from other reputable extended car warranty companies. That way, you can compare these free quotes to make sure you’re paying the best rates for coverage.

Endurance: Best Overall

Endurance is a direct extended warranty provider, meaning it offers and fulfills most plans without brokers or middlemen. The warranty provider offers six levels of coverage ranging from bumper-to-bumper warranties to basic powertrain warranties. All Endurance vehicle service plans come with 24/7 roadside assistance, trip interruption coverage, and rental car reimbursement.

Endurance also has many positive customer service reviews. The warranty provider has a 3.7-star rating on both Trustpilot and the BBB website. Positive Endurance warranty reviews touch on the company’s competitive rates and customer service.

Learn more: Endurance warranty review

CARCHEX: Best for Used Cars

CARCHEX is a leader in the extended warranty industry and has provided services to drivers for over 20 years. The company specializes in plans geared toward high-mileage vehicles, which is why we named CARCHEX as Best for Used Cars. The warranty provider offers five vehicle protection plans that are customizable to fit the needs of your car.

CARCHEX has decent ratings across customer review outlets. The warranty provider earned an A+ rating from the BBB and holds a 2.6-star rating on Trustpilot.

Learn more: CARCHEX review

Protect My Car Review: FAQ

Below are some frequently asked questions about Protect My Car reviews.

Is Protect My Car legit?

Yes, Protect My Car reviews reveal that the company is a reputable extended warranty provider backed by high marks from the BBB and Trustpilot. In our extended car warranty review, we gave Protect My Car a score of 4.4 out of 5.0 stars.

How much does Protect My Car cost?

Based on our research, the Protect My Car Ultimate plan costs between $100 and $130 per month for four years of coverage. Compared to other car warranty providers, Protect My Car’s costs are a bit above average. Extended car warranty prices depend on your vehicle’s make, mileage, and age.

How does Protect My Car work?

Protect My Car offers standard extended car warranties. If a mechanical breakdown occurs, Protect My Car pays the repair bill for covered vehicle components. You’re only responsible for a deductible and the cost of the contract. If you’ve opted for one of Protect My Car’s combination plans, routine maintenance services will also be covered.

What is the Protect My Car service number?

If you need to reach customer support, you can call the Protect My Car service number at 1-800-253-2850. You can use this number to speak with someone about the details of your plan or to ask any questions you might have.

How do you cancel Protect My Car?

To cancel your Protect My Car extended warranty, you need to complete the online cancellation form. Then, call 1-800-253-2850 to initiate the cancellation process. Finally, send your completed cancellation form to the company through registered mail.

Does Protect My Car cover body damage?

Protect My Car warranties, like nearly all car warranties, don’t cover body damage. That’s because they’re not meant to. Body damage is typically covered by your car insurance policy, depending on which coverage types you have.

Is Protect My Car the same as CarShield?

Protect My Car and CarShield are separate companies and are unrelated. However, both are reputable providers of extended auto warranties.

Does Protect My Car cover transmissions?

Yes, every Protect My Car service contract covers expensive transmission repairs.

Does Protect My Car cover oil changes?

All Protect My Car extended warranty plans include up to three free oil changes per year. This is a useful benefit that’s uncommon in the vehicle service contract industry.

Does Protect My Car cover damage from a car accident?

Protect My Car doesn’t cover damage from a car accident, even to listed components. That responsibility may fall on your insurance company.

How long has Protect My Car been in business?

Protect My Car has been in business for over 18 years. The company first opened in 2005.

Does Protect My Car have a waiting period?

Protect My Car has a 30-day waiting period on its warranty plans, meaning you can’t use the coverage within the first 30 days of signing your contract.

Who owns Protect My Car?

Since 2018, Protect My Car has been owned by Crestview Partners, a New York-based company.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best extended auto warranty providers.

- Industry standing: Our team considers Better Business Bureau (BBB) ratings, availability, and years in business when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car warranty company offers an array of coverage options. We take into account the number of plans offered by each provider, term limits, exclusions, and additional benefits.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team performs ongoing secret shopper analyses for different vehicles, mileages, warranty plans, and locations to give this rating.

- Transparency: We consider the transparency of each company’s contracts and the availability of a money-back guarantee when determining this score.

- Customer service: Reputable extended car warranty companies operate with a certain degree of care for consumers. We take into account customer reviews, BBB complaints, and the responsiveness of the customer service team.

*Data accurate at time of publication.